Plan My Future

Lloyds Banking Group

Role

Product Designer

Product Team

Experience Design | Digital Engagement & Future Propositions

Duration

10 months

Project

Problem

Based on some JTBD research that was previously done, it became apparent that the most underserved JBTD was customers planning for their future. Customers who have goals from the immediate to long-term often don’t know how to best reach those financial goals outside of putting money in a savings account.

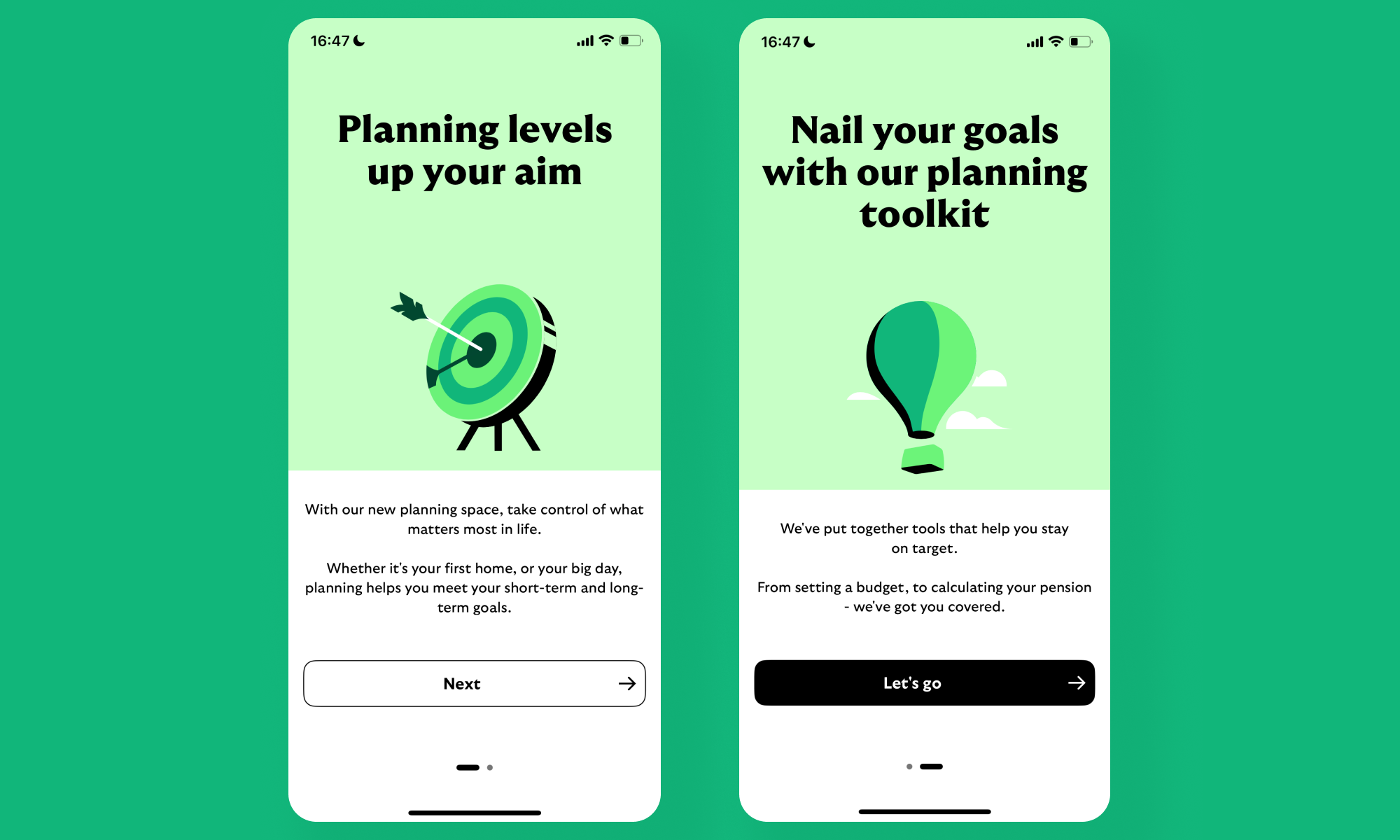

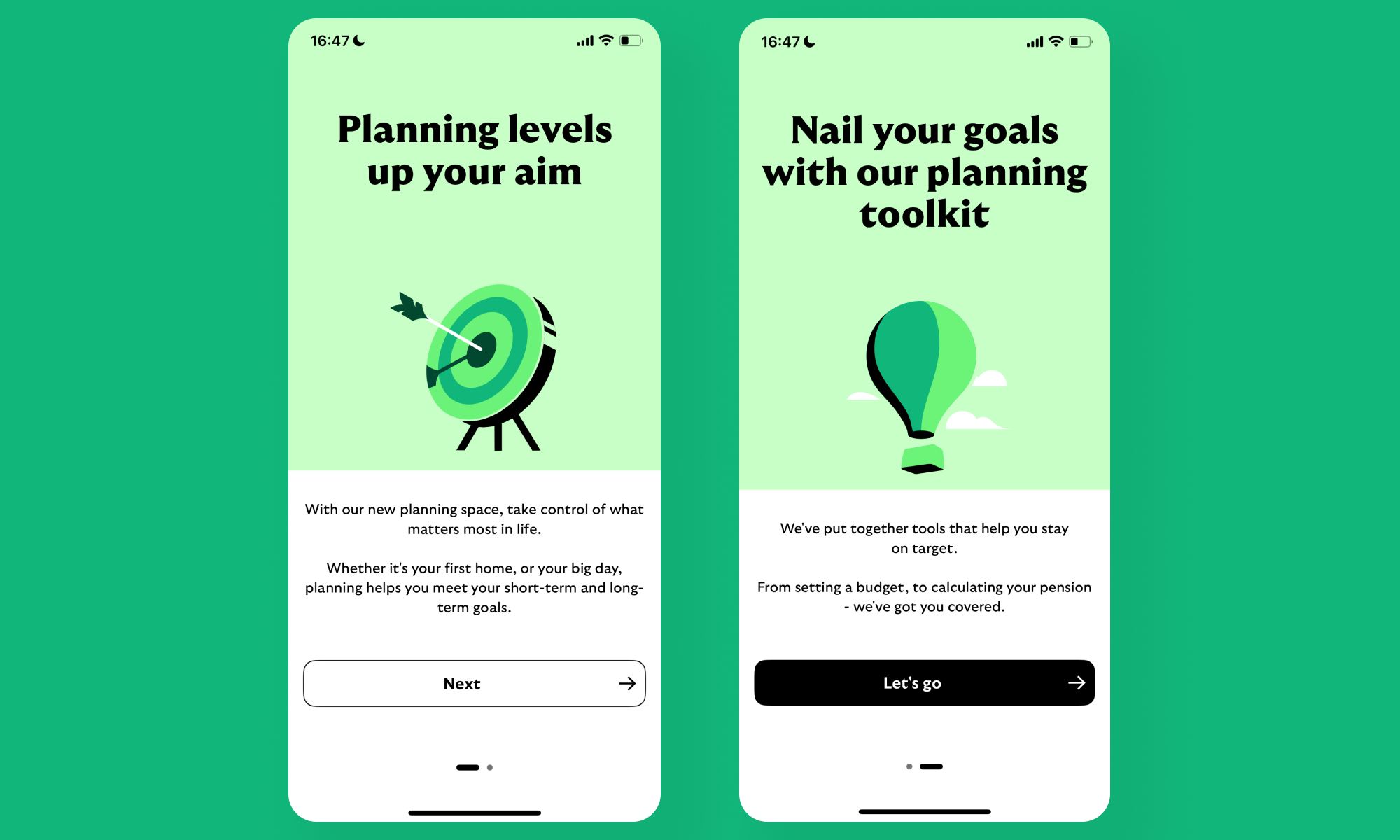

Solution

There’s an opportunity to develop a proposition to help customers plan their future finances in a way that allows them to prosper going forward. In this project, I was the Product Designer for the Discovery Squad, working with Service Design, UX Research, and Design in the Delivery Squad.

Process

-

The ask was to ground the proposition in real customer insight. I synthesised research findings, supported user interviews, and turned the raw data into clear narratives that senior leaders could act on. During testing, I probed customer comfort around data privacy and the role of AI in their financial planning, uncovering the boundaries of trust and where the experience needed to reassure. The insights directly shaped product decisions.

I also led discovery research exploring best-in-class tech capability and features across FS and non-FS sectors. The competitive benchmarks and narrative insights I produced helped senior stakeholders align on the proposition’s direction.

-

I designed a set of AI-assisted and highly automated experiences, leveraging the human-AI interaction models, that let users model life goals, simulate alternate futures, receive automated, data-based recommendations, and even automate repetitive financial actions.

I partnered closely with data science and engineering to ground the concepts in real delivery capability, align with the bank’s AI strategy, and set the foundations for fully AI-assisted financial-planning journeys. The work created a clear direction for how the proposition could evolve into a more intelligent, predictive planning experience.

-

The ask was to design an ideation workshop that would pull stakeholders out of their assumptions and into the lived reality of our users, so we could validate the proposition and prioritise what to build first.

I took this further and designed an immersive experience inspired by immersive theatre. I opened with a tight synthesis of our research, then guided stakeholders through a narrative walkthrough of each user’s world. To force genuine empathy, I brought in real user-testing audio clips so they could hear frustrations and goals directly from customers.

I used ElevenLabs to generate contextual sound design and Midjourney to create short scenario videos that placed each user in the middle of their need. I produced fact sheets and supporting artefacts to anchor an improv-based activity where stakeholders acted out each user’s challenges and generated solutions from inside the persona’s mindset.

The output was a set of co-created solution ideas that later fed into early concepts and helped align the group on the priority journeys to design and build.

Impact Highlight: Quote Summary

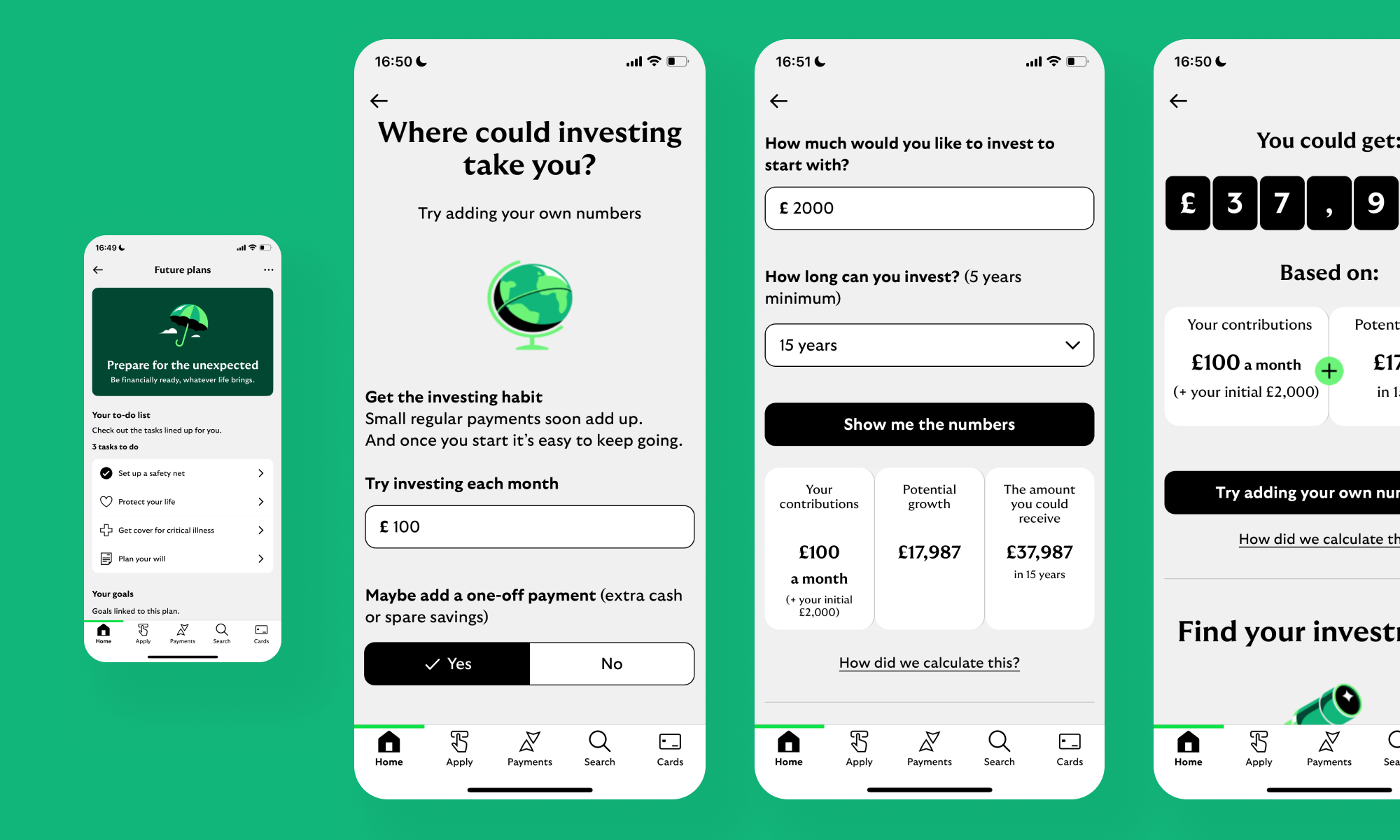

Some of the non-AI concepts I designed for the Plan My Future proposition were adopted for the initial release of the Start Investing tab, shaping elements of the first customer-facing experience.

Opportunity

While mapping the service ecosystem for Plan My Future, I was pulled into a high-pressure, one-day brief from our Director and Design Lead. The ask: design an experience that recognises Premier customers for the work it takes to earn that status, with a concept strong enough for the Group CMO and suitable for social channels.

Balancing other time-critical deliverables, I moved fast, reframed the problem, mapped the emotional moment, and produced a clean end-to-end flow with a narrative that felt earned. The concept landed well with senior leadership and became the basis for expanding customer-recognition touchpoints.

-

To make sure the work genuinely added value, I synced with Designers in the Premier Banking squad to understand the current onboarding flow and dug through the existing design files to identify where a recognition moment could naturally fit.

-

Knowing customers aren’t all motivated by the same things, I designed the flow to give them a choice in how they want to be recognised—while clearly framing why the bank celebrates them: they’ve earned it.

To reduce apprehension around privacy, I added a preview step so customers could see exactly what would be posted before giving consent.

And to avoid messy back-and-forth with the bank, I introduced an API-based “connect with your social platform” step—similar to Google/Apple sign-in—allowing the social team to publish and tag customers seamlessly.

-

I walked my Director and several Design Leads through the flow and the rationale behind each decision, including an additional concept that let customers publicly recognise Lloyds for positive moments directly from the app. The panel were satisfied with the direction and the opportunities it opened.