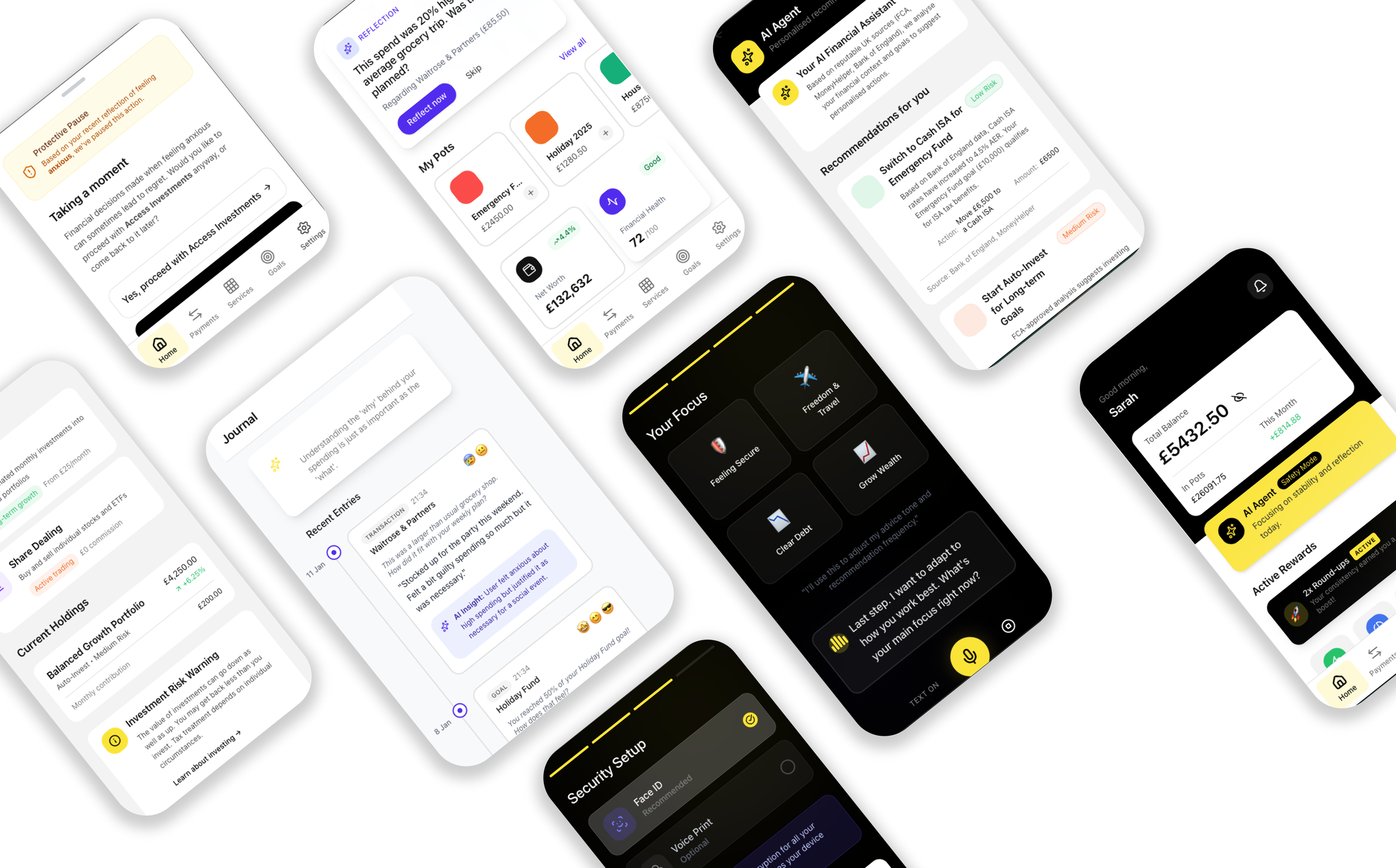

Fintech OS

After years working across design and financial services, I wanted to rethink what "banking" actually means for ordinary people. Most apps obsess over transactions and growth metrics. Very few look at behaviour, emotion, and long-term wellbeing. This project imagines a multimodal, AI-assisted banking experience that's as empathetic as it is powerful — combining everyday payments, savings, goals, investing, borrowing, and pensions into a single operating system that helps users make better decisions, protects them when they're vulnerable, and motivates them when they're on track.

UK consumers juggle multiple bank accounts, budgeting apps, and savings pots. They make financial decisions under stress or with limited information. Traditional banks sell products. Challenger banks optimise for speed. Neither genuinely helps people understand their behaviour or build lasting wealth. And too often, tools ignore accessibility and end up excluding people with different needs.

I defined the vision, designed the UX, mapped user journeys, wrote the AI behavioural rules, crafted the multimodal voice UX, and led the design system extension. I also outlined the regulatory and safety requirements to ensure the concept would meet FCA guidance and Consumer Duty principles.

The system unifies day-to-day money, long-term goals, payments, and wealth-building through a Payments Hub for sending, requesting, splitting bills, and international transfers with in-app messaging and QR codes. Messaging is moderated to block abusive content — repeat violations freeze the account until review.

Pots & Goals support up to 12 purpose-driven pots with optional virtual cards. Goals track long-term targets like buying a home or building an emergency fund, with streak tracking to encourage consistent contributions.

The Services Hub lets users open savings accounts, ISAs, investment portfolios, credit products, mortgages, and pensions via voice-first onboarding. Users answer tailored questions so the AI can personalise suggestions — it always explains risks and never proceeds without consent.

Net Worth & Health provides a live view of assets and liabilities — bank accounts, investments, property — plus a financial health score benchmarked against UK averages.

The AI Coach & Reflection layer invites users to journal after transactions or reports about how they feel. The AI recognises patterns, delays recommendations when users feel stressed, and celebrates improvements. Completing challenges or maintaining streaks unlocks loyalty points, cashback boosters, or temporary higher savings rates.

Undo & Safety gives every eligible money movement a five-minute undo window. High-risk actions require extra verification and are blocked on devices like car dashboards or smart speakers. Gambling and adult payments are prohibited.

I began by mapping typical user journeys — paying a friend, saving for a house, transferring a pension — and identifying friction points. I designed voice and text flows that mirrored each other. I prototyped the journaling and AI-insight interface to ensure it felt human rather than robotic. To validate safety and ethical considerations, I created a risk matrix and user-state gating rules — no investment recommendations during anxiety spikes, for instance. The design system was extended with new components like streak indicators and journaling cards while maintaining existing tokens and accessibility standards.

This project reframed banking from a transactional chore into a holistic experience. It demonstrates how design, AI, accessibility, and regulation can coexist to improve real lives. Beyond the concept, it's a manifesto for putting user wellbeing at the core of financial products — and if realised, it could transform not just an app, but the financial behaviours and futures of its users.

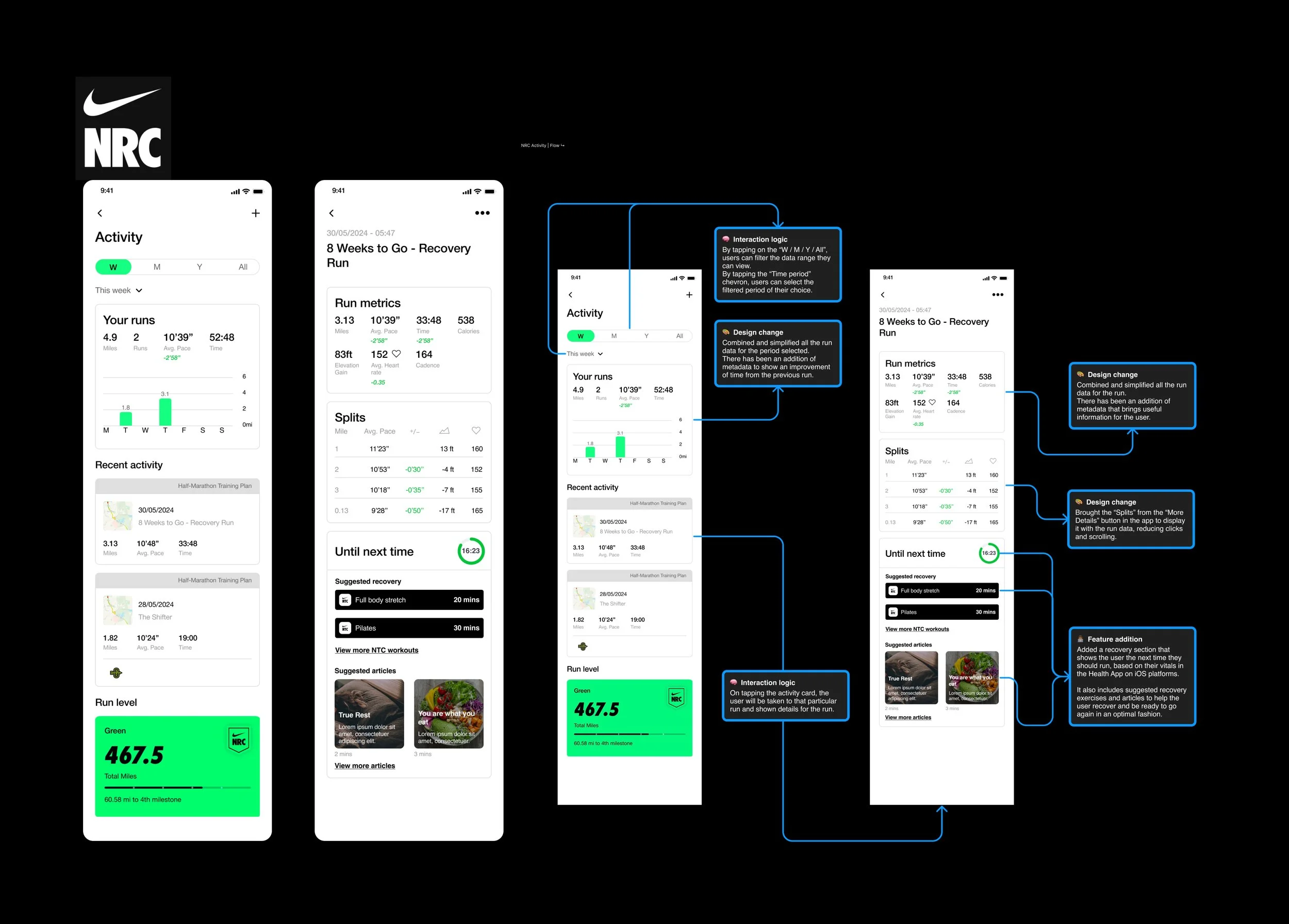

Design Task

The ask was simple: redesign and improve any feature from an app of my choice. I chose the Nike Running Club Activity tab — a feature I use often and one that consistently fails to answer a basic question for runners: am I actually improving?

I mapped the experience from my own use and validated it with another runner. We both hit the same friction — the most valuable metric, Splits, was buried behind a “More details” tap and extra scrolling. So I pulled Splits forward into the primary view, giving runners immediate performance insight without the hunting.

I also designed a Recovery module, showing how long until the next recommended run, with integrated Nike Training Club exercises and relevant articles — turning the Activity tab into a hub that connects performance, recovery, and the broader Nike ecosystem.

African Ancestry

UX Consultant | 🕵🏾♂️

The ask was to define a solution and craft an immersive experience that would help customers connect with their heritage in a way a results certificate never could — something emotional, memorable, and deeply informative.

I shaped the experience around narrative, not data. I explored how storytelling, sensory cues, and contextual visuals could turn ancestry information into something you feel, not just read. I mapped the end-to-end journey, identified the emotional peaks, and designed concepts that revealed heritage through immersive scenes, guided moments, and layered insights that gave users a richer sense of identity.

The work provided a clear direction for how the product could move beyond static results and become an experience that genuinely resonates with people on a personal level.

To define the right direction, I pulled the whole ecosystem together — the Co-Founder, Ops Manager, developers, previous third-party designers, and a junior team of designers and analysts. I ran a series of workshops and working sessions to surface context, constraints, and institutional knowledge.

I dug into their data and customer insights to understand the existing journey end-to-end and where the experience fell short emotionally and narratively. Using HMW statements, I reframed the current product and re-imagined it as an immersive, story-led journey — one that could be powered through APIs, external platforms, and rich audio-visual layers unique to their offering.

This became the foundation for a product vision that went beyond incremental improvement and pushed toward an immersive experience unlike anything currently in the market.

Bantu

Product Consultant | 🕵🏾♂️👨🏾💻

I joined a London FinTech as a product consultant to help redefine and redesign their payments solution. I led the entire design process end-to-end, from discovery through to delivery, and brought in a Junior Designer whom I managed throughout the project. I shaped the problem space, ran user and stakeholder discovery, built the new design direction, and delivered the core flows and interface patterns that anchored the refreshed payments experience.

We began with a competitive analysis to understand where the product could fit in the market. From there, I kicked off mixed-method research — surveys and user interviews — to test viability and uncover the real pain points people face when communicating about money, pooling funds, and transacting together.

I translated the insights into Personas and an Experience Map, which became the backbone of a workshop I led with the team. Using HMWs, Crazy 8s, voting, and prioritisation, we co-created a direction that balanced the business objective with genuine customer need.

I then designed the full end-to-end experience, produced the screens, and prototyped key journeys for testing. After running user testing, I compiled the findings into a report, guided the prioritisation of changes, and iterated the designs based on the insights.

Once the updated concepts were complete, I produced a handover pack that equipped the Bantu team with everything they needed to move toward fundraising and early build discussions.

Nike HOOPS CLUB

UX Consultant | 🕵🏾♂️

I developed a basketball app concept built around Nike’s tech ecosystem and partner network, and pitched it to several Senior Product Leaders across Nike EMEA. The vision showcased how Nike could extend its performance, community, and commerce capabilities into a new, basketball-focused experience.

I interviewed and surveyed basketball players across levels, along with agents and trainers, to uncover gaps in skills development, access to quality training, and the visibility athletes need to progress.

From these insights, I shaped a solution that delivered NBA-level skills training, trackable strength and conditioning, world-class recovery, and a competitive community layer — all designed to democratise elite basketball development regardless of geography.

The concept leveraged Nike’s partnerships and technology ecosystem to make high-performance coaching and progression accessible to every athlete, not just those with proximity to pro-level resources.